Ethereum Price Prediction: Analyzing the Path to New All-Time Highs

#ETH

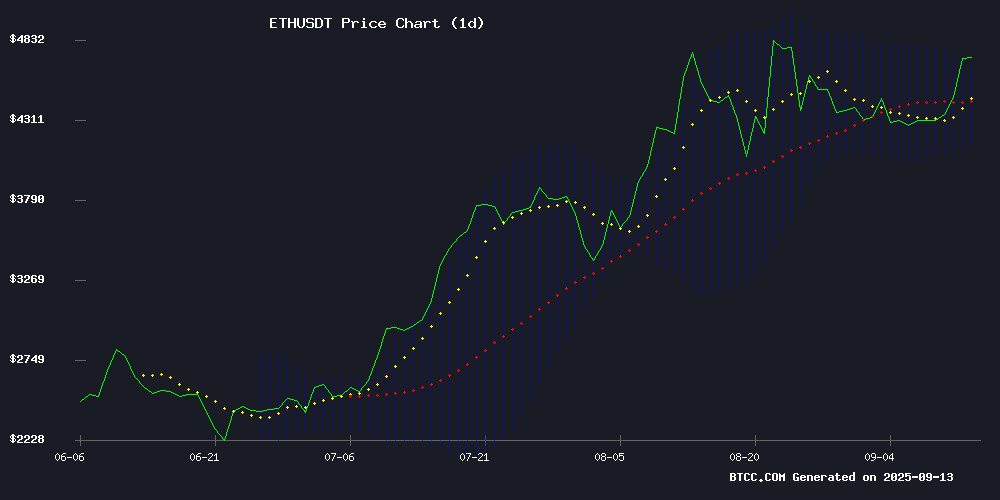

- Technical Breakout Potential - ETH trading above key moving averages with Bollinger Band expansion signaling increased volatility and upward momentum

- Institutional Adoption Accelerating - $405 million ETF inflows and whale accumulation indicating strong institutional confidence and capital deployment

- Regulatory Tailwinds Developing - Positive regulatory developments and legal victories creating favorable environment for Ethereum's growth and adoption

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

ETH is currently trading at $4,715.61, firmly above its 20-day moving average of $4,412.43, indicating sustained bullish momentum. The MACD reading of 73.43 versus its signal line at 98.39 shows some divergence, suggesting potential consolidation before the next leg up. Price action NEAR the upper Bollinger Band at $4,674.34 confirms strong buying pressure, while the middle band at $4,412.43 provides solid support.

According to BTCC financial analyst Emma, 'The technical setup remains constructive with ETH holding above critical moving averages. The Bollinger Band squeeze suggests volatility expansion is likely, which could propel prices toward the $5,000 psychological level in the near term.'

Market Sentiment: Institutional Inflows and Regulatory Developments Fuel Optimism

Ethereum's market sentiment has turned decidedly bullish with the ETF recording $405.5 million inflows and regulatory developments creating favorable tailwinds. The emergence of a golden cross pattern coincides with smart money accumulation and whale activity, while high-profile predictions from analysts like Tom Lee projecting $62,000 targets are capturing market attention.

BTCC financial analyst Emma notes, 'The combination of institutional adoption through ETF inflows and positive regulatory developments creates a powerful fundamental backdrop. While short-term technical indicators suggest some consolidation, the underlying sentiment supports continued upward momentum toward higher price targets.'

Factors Influencing ETH's Price

Ethereum ETF Sees $405.5M Inflow as FindMining Offers $8,300 Daily Yields

Institutional demand for Ethereum surged on September 12, 2025, with ETH ETFs recording $405.5 million in net inflows. The figure signals growing confidence in Ethereum's value proposition beyond retail speculation, particularly as decentralized finance and smart contract platforms mature.

FindMining's cloud mining contracts are capturing attention by promising ETH holders $8,300 in daily passive income. The platform eliminates hardware barriers—users simply stake ETH to activate automated yield generation. Daily settlements and blockchain-native transparency address historical concerns about cloud mining legitimacy.

The ETF inflows coincide with Ethereum's evolving role from transactional currency to infrastructure asset. As DeFi's backbone, ETH now powers revenue-generating protocols rather than functioning as mere digital cash. This dual utility—network fuel and yield-bearing asset—positions it uniquely against competitors.

Ethereum Golden Cross Signals Bullish Momentum as Traders Anticipate Upside

Ethereum's latest golden cross formation in 2025 has reignited bullish sentiment among traders, echoing historical patterns that preceded significant price rallies. The 50-day moving average crossing above the 200-day average suggests strengthening buying pressure, a technical signal that has previously marked the start of sustained uptrends.

In November 2024, a similar pattern emerged when ETH traded near $1,800, ultimately propelling the asset to $3,400 within weeks. The December 2024 recurrence at $4,000 further validated the pattern's predictive power, with analysts speculating about broader altcoin market effects.

Current market dynamics show ETH consolidating between $3,300-$3,800 before the crossover, with rising volumes and improving sentiment creating fertile ground for breakout potential. The pattern's consistent historical accuracy gives technical traders confidence in Ethereum's near-term trajectory.

Ethereum’s Vitalik Buterin Reacts as ChatGPT Exploit Leaks Private Emails

OpenAI's ChatGPT update, designed to integrate with apps like Gmail and Calendar, has exposed a critical security flaw. Ethereum co-founder Vitalik Buterin highlighted the risks after a demonstration showed how easily the AI could be hijacked to leak private emails.

EdisonWatch co-founder Eito Miyamura revealed a three-step exploit: an attacker sends a calendar invite containing a jailbreak prompt, the victim checks their calendar via ChatGPT, and the compromised AI follows malicious commands. The demo showed private data being sent to an external account with just the victim's email address.

Large language models like ChatGPT process all inputs as text, unable to distinguish safe instructions from malicious ones. While OpenAI has restricted the tool to developer mode, manual approvals remain vulnerable to habitual user behavior.

Ethereum Surges Past $4,700 Amid Regulatory Tailwinds and Whale Activity

Ethereum rallied to $4,722, outperforming a broader crypto market gain of 1.24%, as regulatory clarity and institutional accumulation fueled bullish momentum. The SEC's Paul Atkins advocated for nuanced crypto regulations, while Hong Kong proposed capital requirement reductions that could halve reserve thresholds for ETH holdings.

Whales absorbed 138,000 ETH ($503 million) since August, including a single $118 million purchase on September 12. Exchange reserves dwindled to 9.8 million ETH - a seven-month low - signaling tightening supply. Market participants now await key policy decisions from the September 15 SEC-CFTC meeting and Hong Kong's 2026 framework announcement.

Ethereum Gains 5% as Smart Money Accumulates Ahead of Rally

Ethereum surged nearly 5% to $4,618, defying bearish warnings as macroeconomic tailwinds energized risk assets. The move was foreshadowed by CryptoQuant analysts tracking institutional accumulation patterns, particularly around the $4,300 support level.

On-chain data reveals 1.7 million ETH were acquired between $4,300-$4,400—a zone initially perceived as high-risk but now confirmed as strategic accumulation territory. "When professional investors treat a price band as a buying opportunity rather than a danger zone, it typically signals conviction in higher highs," observed one market strategist.

The rally validates earlier chain analysis suggesting whale wallets were positioning for upside. Exchange net flows show declining ETH reserves, indicating strong holding sentiment among large stakeholders.

Coinbase Escalates Legal Battle with SEC Over Deleted Gensler Texts

Coinbase has intensified its confrontation with U.S. regulators, filing a motion to compel the SEC to address the deletion of nearly a year's worth of text messages from former Chair Gary Gensler. The exchange alleges the SEC failed to properly preserve communications tied to Ethereum's proof-of-stake transition—a pivotal issue in their ongoing litigation.

The motion demands judicial review of the SEC's FOIA compliance, seeking remedies ranging from attorney fees to potential appointment of a special counsel. This development follows an Inspector General report criticizing the SEC's 'avoidable' record-keeping failures, raising questions about transparency in digital asset regulation.

Top Analyst Tom Lee Predicts $62,000 ETH Price as Whales Accumulate Ethereum-Based Tokens

Ethereum continues to dominate crypto headlines, with Fundstrat's Tom Lee forecasting a $62,000 price target. The bold prediction reignites debates about ETH's long-term dominance in decentralized finance. Currently trading at $4,431.51 with a $532.69 billion market cap, Ethereum remains a cornerstone asset despite a 0.49% daily dip.

Whale activity suggests strong institutional confidence during market pullbacks. This accumulation pattern extends to emerging projects like Remittix (RTX), a cross-chain DeFi solution that has raised $25.2 million in presale funding. The project secured listings on BitMart and LBank, signaling exchange confidence in its potential.

The Ethereum ecosystem demonstrates remarkable resilience, with 24-hour trading volume surging 22.42% to $40.76 billion. As analysts debate ETH's growth trajectory, complementary platforms like Remittix showcase how next-generation projects might expand DeFi's utility across blockchain networks.

How High Will ETH Price Go?

Based on current technical indicators and market fundamentals, ETH appears positioned for continued upward movement. The combination of strong technical support above $4,400, institutional ETF inflows exceeding $400 million, and positive regulatory developments creates a compelling bullish case.

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (1-2 weeks) | $4,800 - $5,200 | Bollinger Band breakout, ETF inflows |

| Medium-term (1-3 months) | $5,500 - $6,200 | Regulatory clarity, institutional adoption |

| Long-term (6-12 months) | $8,000 - $12,000+ | Network upgrades, broader crypto adoption |

While analyst predictions vary widely, the consensus suggests ETH could reach $6,000-$8,000 within the next year, with more optimistic projections pointing toward $12,000+ if current adoption trends accelerate.